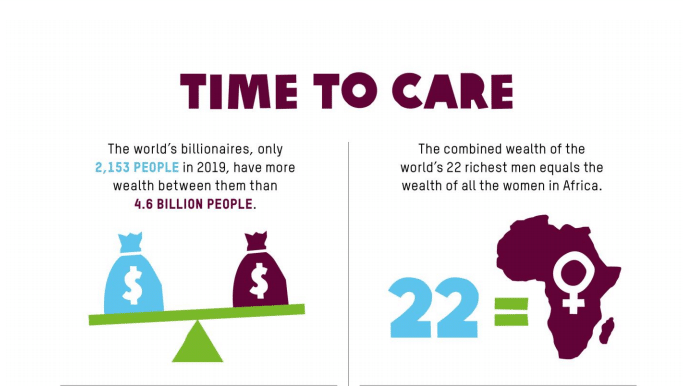

This is one of the main conclusions in Oxfam Novib's report released today "Time to Care": the number of billionaires has doubled in the last decade, but at the same time the super-rich and multinationals are paying less and less tax. No wonder global inequality has increased. Over 2,000 billionaires in the world are together richer than 60% of the world's population, 4.6 billion people. And unfortunately, the Netherlands plays a bad role in this as a tax haven.

Netherlands tax haven

This is because the Dutch tax system allows large multinationals to pay less or no tax through all kinds of complicated constructions. Because of such constructions, developing countries lose about 100 billion a year. And this while taxes are crucial for development of public services and goods such as education, healthcare and infrastructure. To increase this percentage, countries like the Netherlands must prevent the super-rich and multinationals from funnelling money out of developing countries untaxed. To show the difference: in richer countries, tax revenues equal about 40% of GDP. In developing countries, tax revenues are much lower, between 10 to 20% of GDP.

Djaffar Shalchi, founder of "Human Act" and a multimillionaire himself, tells how important taxes have been for him, as an Iranian migrant in Denmark. "People sometimes call me a 'self-made' multimillionaire. Nothing could be further from the truth. Yes, I have worked hard in my life. I am proud of what I have achieved. But the truth is I could not have done any of this without help from the Danish welfare system, and the taxes paid by the people to create our happy and equal society."

Time to take action!

Oxfam Novib's report shows, once again, that now is really the time for the Netherlands to tackle tax evasion. As a member of Tax Justice Netherlands we as FMS are also pushing hard for this. Multinationals should be required to be transparent about their presence, activities, profits and taxes per country and worldwide. The Netherlands should also tighten tax rules so that tax avoidance not only goes against the spirit of the law, but also becomes illegal. In addition, the European Union must work hard to reduce the international tax race. This is the only way to avoid continuing to support countries through development cooperation with one hand, while taking more money from them by facilitating tax avoidance with the other.

Image: Oxfam Novib report Time to Care